Weekly Updates

Embracing Change: Navigating the Impact of the CMS Final Rule 2025 and Diversifying Your Portfolio for Success

Embracing Change: Navigating the Impact of the CMS Final Rule 2025 and Diversifying Your Portfolio for Success

In the ever-evolving landscape of the insurance industry, staying ahead of regulatory changes and diversifying your portfolio are key strategies for success. As we delve into the implications of the Centers for Medicare & Medicaid Services (CMS) Final Rule for 2025, and the opportunities it presents, it's crucial to equip ourselves with the knowledge and tools necessary to thrive in this dynamic environment.

Understanding the Impact of the CMS Final Rule 2025:

The CMS Final Rule for 2025 introduces significant changes that directly impact insurance agents and agencies. From adjustments in agent compensation to stricter lead regulations and alterations in Third-Party Marketing Organization (TPMO) compensation, these shifts reshape the industry landscape.

1. Agent Compensation: The Final Rule imposes new guidelines aimed at enhancing transparency and fairness in agent compensation structures. Agents must adapt to these changes, which may affect their revenue streams and business operations.

2. Lead Regulations: Stricter regulations are imposed on lead generation practices to protect consumers from deceptive marketing tactics. Compliance with these regulations is paramount to maintain ethical standards in marketing efforts.

3. TPMO Compensation: Changes in TPMO compensation structures are implemented to ensure fair practices and transparency in TPMO-agent relationships. Agents affiliated with TPMOs should be mindful of these changes and adjust their strategies accordingly.

Why Agents Should Consider Diversifying Their Portfolios:

Against the backdrop of the CMS Final Rule 2025, diversifying your portfolio offers numerous benefits for agents and agencies alike:

1. Mitigating Revenue Risks: Diversification reduces reliance on a single product or market segment, mitigating the risk of revenue fluctuations due to regulatory changes or shifts in consumer preferences.

2. Meeting Diverse Client Needs: Diversification enables agents to cater to the varied needs and preferences of their client base more effectively. By expanding their product offerings, agents can address a broader range of healthcare requirements, enhancing client satisfaction and loyalty.

3. Enhancing Competitive Advantage: Differentiation is key to maintaining a competitive edge. Diversifying product portfolios allows agents to differentiate themselves from competitors, positioning themselves as comprehensive solution providers capable of meeting varied client needs.

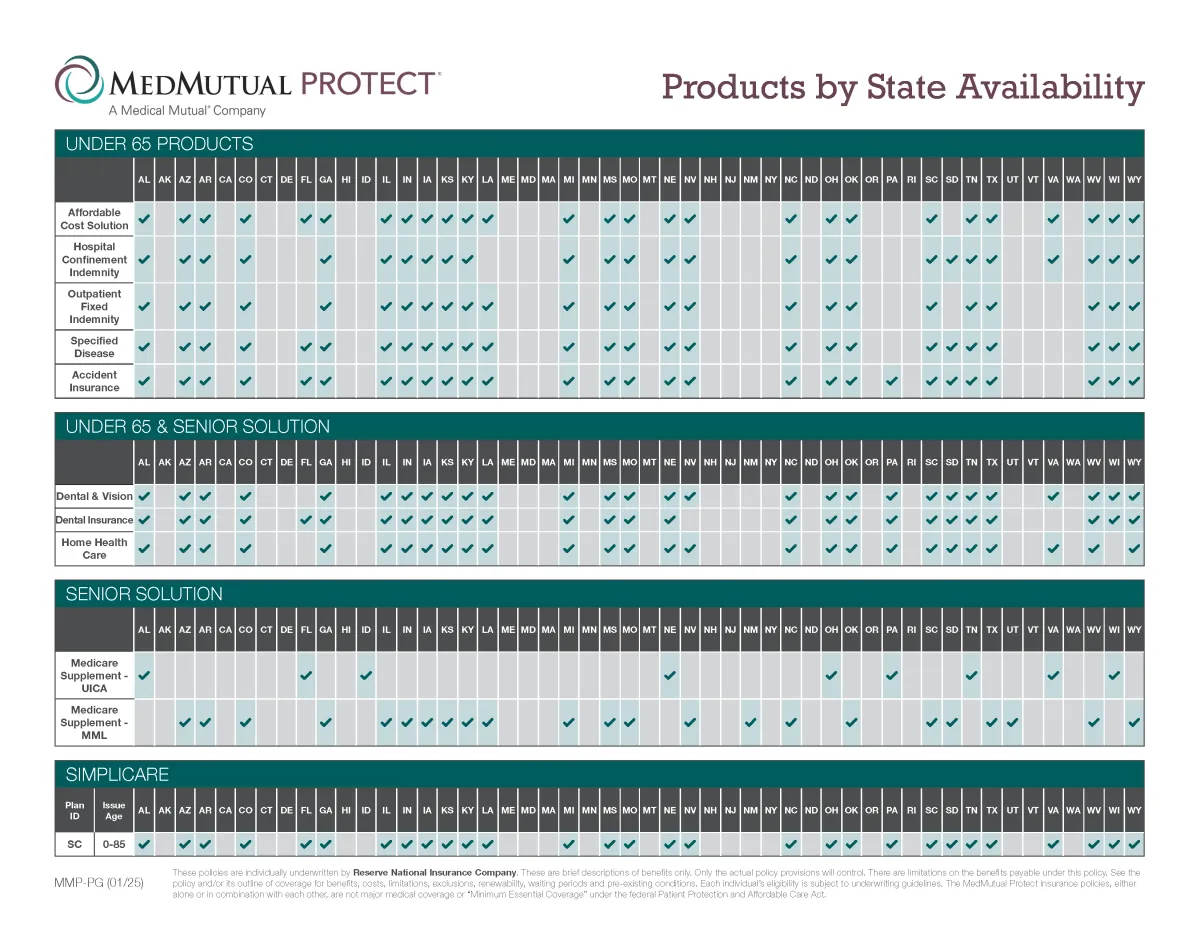

Adding MedMutual Protect to Your Portfolio:

In light of the CMS Final Rule 2025 and the imperative to diversify, MedMutual Protect presents a compelling opportunity for agents and agencies:

1. Comprehensive Coverage: MedMutual Protect offers comprehensive coverage options that cater to various healthcare needs, providing clients with peace of mind and financial protection against unexpected medical expenses.

2. Competitive Advantage: By adding MedMutual Protect to your portfolio, you can differentiate yourself from competitors and position yourself as a comprehensive solution provider capable of meeting diverse client needs.

3. Client Satisfaction: Offering MedMutual Protect enables you to enhance client satisfaction by providing access to quality healthcare coverage that aligns with their unique preferences and requirements.

4. Business Protection: Diversifying your portfolio with MedMutual Protect helps protect your business against market fluctuations and regulatory changes, ensuring resilience and sustainability overall.

As agents and agencies, it's essential to embrace change, navigate regulatory complexities, and seize opportunities for growth. By understanding the implications of the CMS Final Rule 2025 and diversifying your portfolio with products like MedMutual Protect, you can position yourself for success in an increasingly dynamic marketplace. Let's adapt, innovate, and thrive together.